Medicare Commissions Calculation

Commissions for Policies with MAPD and PDP Product Types calculated differently than ones for other Product Types. Each Street/Override field is calculated independently.

similarities with Fixed Amount commissions for non-MAPD, calculations for MEDICARE commissions automatically apply a pro-rating factor when the amount in the field is different than the full amount of the top-level commission rate.

An admin has options to run commissions for all Policy Transactions or by specific criteria (Issuers or Product Types.) This also allows MEDICARE and non-MAPD commissions to be calculated in separate cycles or in the same run.

Run Commissions or Commissions Calculation

Selections for running a cycle:

Commission Processing Date – date used to look for transactions, chargebacks, and adjustments to be picked up or applied in the cycle. For commissions, if the Transaction date is the same or less than the processing date, the transaction will be picked up in the cycle. This also means if you have a Policy/transaction with exceptions that cannot be fixed before a cycle needs to be closed, as a last resort the transaction date can be changed to be later than the Commission Processing Date so it is not picked up and commissions on Policy transactions without exceptions can be closed.

Processing Type – The selection choices are: New Enrollments, Monthly Recurring, and Process All.

- New enrollments - For the cycle to pick up for both MAPD, PDP, and non-MAPD only Transactions from Policies that have not had previous commission activity.

- Monthly Recurring – For the cycle to pick up for both MAPD, PDP, and non-MAPD only Transactions that have had at least one previous Transaction that has gone through a Cycle that was closed will be picked up.

- Process All – will pick up all transactions

Issuer – allows selecting one up to all Issuers. The Issuers selected affect the Policy Transactions, Chargebacks, and Adjustments that can be picked up.

Product Type – allows selecting one up to all Product Types.

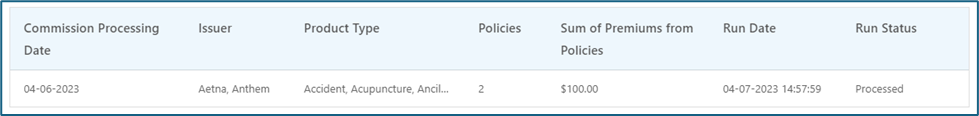

After Run is selected, there will be a line in the grid below that will cycle through different Run status until it becomes Processed. The admin can then select on that line which will open to the pages for the details of the cycle.

Line for a Run in Calculate Commissions page

Information is displayed in the line for the run. The number given for Policies is only for the number of Policies, while the cycle may include multiple transactions for Policies. The Sum of Premiums from Policies usually will not include MEDICARE Policies as typically Premium amounts are not entered as they are not needed.

Commission Calculation Logic for Medicare

The system will look for and pick up Transactions that fit the parameters entered for the run: Commission Processing Date, Processing Type, Issuer, and Product Type

For Policies that have not gone through a previous cycle, it will pull values from the Policy, Transaction, Agent Detail pages, Custom Settings, and Contract Commission Rates to use for the calculation and to create the Commission Distribution when the run is closed. For Policies that are not new, or have a custom Commission Distribution saved, the Agents and Rate information will come from the saved Commission Distribution.

For the first transaction processed for a Policy, when there is not a previously saved Commission Distribution the system will:

- Generate commissions for the Writing Agent (Level 1) and pull Commission Rates from the

Agent’s Contract in Agent Details, or from an Alternate Contract for the Issuer if one exists. - For any one of the Street or Override fields in the transaction that has a value that is not $0, the system will calculate the commission. When calculating the commission, the system will compare the amount in the transaction Street/Override field against the top-level rate and calculate any pro-rating factor. So, for example, if the top-level Street Initial rate is $270 and the amount in the corresponding field in the transaction is $135, the system knows to apply a factor of 50% for all commissions paid for that Street/Override field. (The system at some point will also translate that 50% into months to display 6 as the SI Months in the Results Medicare page as in this example.)

- After completing commission calculation for the Level 1 Agent, it will look at that Agents details for the Upline value, or from an Alternate Upline in custom settings, to start the process calculating commissions for the next Agent, and so on until commissions are completed for the top-level Agent who has ‘Self’ as their Upline.

- Commissions are calculated for each Street/Override field as the rate of the Agent less the rate of the previous Agent. So, if the Override Initial rate for the Level 1 Agent is $0 they get $0, if the next level’s rate is $20 they get $20 ($20 less $0), if the next level’s rate is $30, they get $10 ($30 less $20), and if the next level is $96, they get $66 ($96 less $30).

- After calculating commissions for all Policies (MEDICARE and non-MAPD) for all Agents, the system will look to see if the Agent has Commission on Hold checked or is Terminated and Not Vested and create an Adjustment to take their full net to $0. The Terminated and Not Vested Adjustment will not take away commissions from Vested Products. (See the main Comissio User Guide for more details on these features.)

- If there are any exceptions or warnings, they would be displayed in the exceptions page of the cycle and the lines for the faulty Policy transaction will not appear in the Medicare Results. Errors include when the Commission Rates are not found, or for a transaction in unallocated status.

- Chargebacks (from non-MAPD commissions) can be applied toward income an Agent receives from MAPD or PDP commissions. For Chargebacks to be applied, the Issuer needs to be selected for the run parameters.

- Adjustments can be applied toward income an Agent receives from MAPD or PDP commissions. Adjustments that have an Issuer added require the Issuer be one selected for the run parameters.

- If Agent Credit rules were created, including for MEDICARE Policies, they would be applied to the Writing Agent of Policies matching the rule and displayed in a tab for Agent Credits in the cycle pages.

- Closing the cycle changes the status of: Transactions (including MEDICARE ones), Chargebacks, and Adjustments to ‘Processed.

- When the cycle is closed, Statements are generated, and emails sent to Agents. See section further below in the document for changes to the Statement for the MEDICARE commission activity section.

Results Medicare

If there are MEDICARE Policy transactions included in a cycle, the details for commissions by Policy and by Agent will be displayed in the page under the tab ‘Results Medicare.’ If there are non-MAPD Policy transactions the commission details for them will be displayed in the page under the tab ‘Results.’ Each respective page for Results has a simple search by Policy Number or Agent ID/Name, an advanced search, and column options to hide columns.

Results and Results Medicare tabs outlined with portion of Results Medicare data displayed:

It is best to export data from the cycle. As there is a lot of data for commission details, and scrolling over to the right would be needed to see all columns, it is often best to export the data from the Results, Results Medicare, and the Summary for analysis. It is also good practice to export the data especially when several corrections need to be made as often the run needs to be abandoned after making one correction. That way data can still be available to do research as needed on other commission lines before being ready to run the cycle again.

The fields in the Results Medicare page are:

- Policy Number

- Policyholder

- Issuer

- Product Type

- Plan

- Agent ID

- Name

- Commission Processing Date

- Contract

- Level

- Member Count

- Commission Received

- Street Initial

- SI Months – (Street Initial months)

- Street True-up

- ST Months – (Street True-up months)

- Override Initial

- OI Months – (Override Initial months)

- Override True-up

- OT Months – (Override True-up months)

- Street Renewal

- Override Renewal

- Transaction Type

- Net

Months fields:

The ‘Months’ fields like ‘SI Months’ are there to show when the amount is from a pro-rated number of months. It can show when the commissions for one Street/Override field have a different number of months then another field. A Commission Received amount can include for example 6 months of Street and One Year of Override. It can also be helpful to point out when a value for the months has a number beyond the decimal, like for example 6.2 months, in case the allocation of Street/Override fields may need to be examined.

Similar months fields were not added for the Renewal fields as they are typically only for the one month, or when a full year is paid as that would be a large enough amount to be obvious.

Summary

The summary consolidates the totals from both the Results and Results Medicare pages. It also displays balance and applied information on Chargebacks, Adjustments and Agent Balance. The Summary is unchanged with the addition of the MEDICARE features except having to pull from the two tables of information represented by the different Results pages.

Summary Page

Fields in the Summary page with notes on how they relate to MEDICARE:

- Agent ID

- Name

- Direct Commission – the MEDICARE portion is when the Agent is the Writing Agent (level 1) in the Policy and can include both Street and Override.

- Override Commission – the MEDICARE portion is when the Agent is level 2+ in the Policy.

- Chargeback Balance

- Chargeback Applied – Chargebacks are not created from MEDICARE policies, but if the Chargeback Issuer is selected as one for the run, any open Chargebacks for the Issuer can be applied, and Net from MEDICARE Policies could be used to pay for them.

- Adjustment Balance

- Adjustments Applied

- Admin Fee – Advance-based Admin fees do not apply to MEDICARE Policies. Net Payable commission Admin Fee set up in the System Settings can apply to income from Medicare.

- Net -

- Current Form 1099 – Commissions from all Policies including MEDICARE Policies add to Form 1099.

- Beginning Agent Balance – Agent balance comes from Advances on non-MAPD Policies with one exception. See below for details. *

- New Advances

- Advanced Recovery

- Ending Agent Balance

- Condition – Commission on Hold and Terminated and Not Vested message can be displayed.

*Agent Balance and Medicare. There is one scenario where MEDICARE commissions can increase Agent Balance. If the Agent has negative commissions and there are not enough positive commissions so that the total net would go below $0.00, then the Agent Balance is increased in that amount below zero. So, if Net in the Summary would be -$100, instead the Net becomes $0.00, and Agent Balance would be increased by $100. To pay this off, an Adjustment for $100 with Net and Agent Balance checked would need to be created and applied to use Net from a future cycle to pay off that portion of Agent Balance.